Table Of Content

Your credit score and DTI will also be important factors in determining what interest rate and loan terms you get from the lender. You’ll also need to estimate your future home’s utility bills for electricity, gas, trash and water. You might not be paying for all of these expenses where you live now, or you might be paying less for them because you’re in a smaller place than your future home will be.

In LA, You Can Spend $800,000 on This Tear-Down

The home affordability calculator provides you with an appropriate price range based on your input. Most importantly, it takes into account all of your monthly obligations to determine if a home could be comfortably within financial reach. Your credit score will also significantly impact what type of loan you qualify for and how much you can borrow. Conventional loans require a credit score of at least 680 and above, while other loan programs such as FHA, VA, and USDA loans have laxer requirements. Plus, the length and amount of credit you have will also impact how lenders will be willing to give you. The higher your credit score, the lower your interest rate will be, and the more house you can afford.

Related Content

California landlord says tenants owe $100K in rent but can't evict them due to COVID-19 protections - KGO-TV

California landlord says tenants owe $100K in rent but can't evict them due to COVID-19 protections.

Posted: Wed, 06 Apr 2022 07:00:00 GMT [source]

Most are willing to go up to 43 percent, and in some cases, 50 percent is the cutoff. If you want to shrink your debt-to-income ratio before applying for a mortgage — which is likely a good idea — pay off your credit cards and other recurring debts, like student loans and car payments. Let’s assume you make a 20 percent down payment on a $400,000 house and take out a 30-year fixed mortgage at an interest rate of 6.5 percent. That gives you a little bit of wiggle room to account for property taxes, insurance premiums and other monthly fees to stay under the 28 percent goal of $2,333.

Why it’s smart to follow the 28/36% rule

So, when you’re figuring out how much house you can afford, don’t forget to factor saving for emergencies into the equation. There are several types of home loans, but which one is right for you will depend entirely on what you qualify for and what ultimately makes the most sense for your financial situation. It’s important to remember that the mortgage lender is only telling you that you can buy a house, not that you should. The answer to that question depends on your financial status and your goals. Just because a lender is willing to give you money for a home doesn’t necessarily mean that you have to jump into homeownership. It’s a big responsibility that ties up a large amount of money for years.

How does the type of home loan impact affordability?

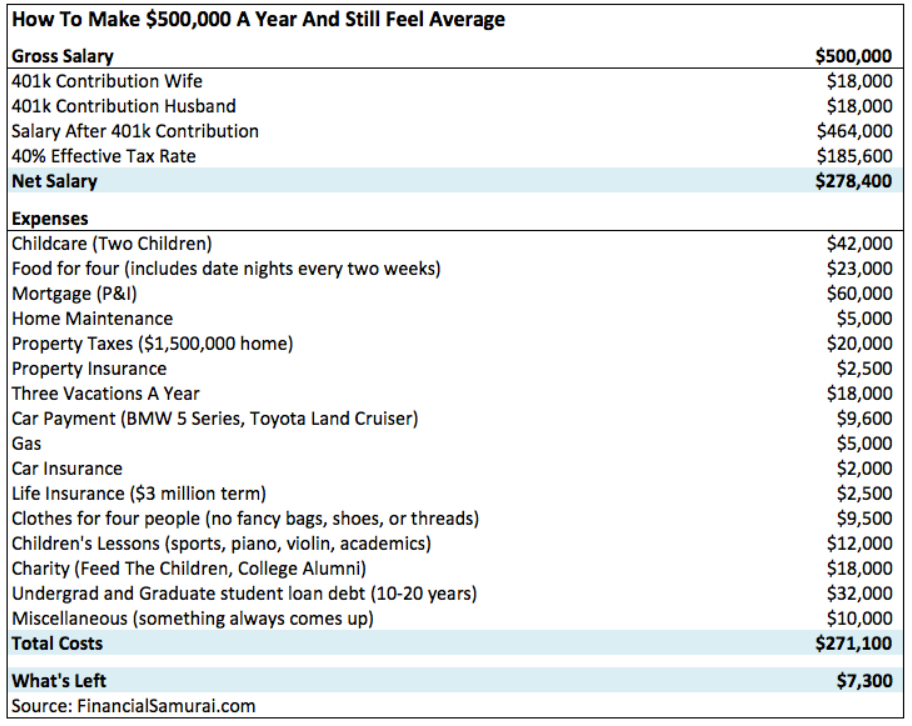

As a middle-class American, there is some expectation for living a lifestyle of relative comfort. But as costs have increased significantly over the last few years, the middle class is now feeling a squeeze in their finances. Accordingly, the income limits that define the middle class have also increased to reflect what most Americans are currently earning. First, it’s important to check your credit report from all three bureaus — Experian, TransUnion and Equifax — for inaccuracies.

In addition to the interest rate, it takes into account the fees, rebates, and other costs you may encounter over the life of the loan. The APR is calculated according to federal requirements and is required by law to be stated in all home mortgage estimates. This allows you to better compare how much mortgage you can afford from different lenders and to see which is the right one for you. If you can afford a 15-year mortgage rather than a 30-year mortgage, your monthly payments will be higher, but your overall cost will be drastically lower because you won’t be paying nearly so much interest. Let's say you have young children whose daycare and summer camp costs are exorbitant. Or, let's say you have a medical condition that requires you to spend more than the average person on medication and care.

The report, published Aug. 1, used data from Home Sweet Home to map out the salary needed to buy a home in the nation's 50 biggest cities. Of the cities analyzed, San Jose, San Diego, Los Angles and San Francisco were listed as the four most expensive housing markets in the nation. "Don't let that number scare you. Because when it comes to obtaining financing, there's different programs," she said. "Consult with the mortgage broker. See where you stand. They'll be able to guide you on your buying power."

So, a higher credit score will equate to a more competitive interest rate on your loan, and thus a lower monthly mortgage bill. This borrower could afford up to $358,600 while staying within the 28% rule. That would be a monthly mortgage payment of $1790 and taxes and fees of $543 for a total monthly payment of $2,333.

Check your home buying budget

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Even if you apply for a conventional loan that doesn’t have income limits, your home’s value cannot exceed a certain amount of money — known as conforming loan limits. Now, let’s look at an example of a homebuyer who makes $100,000 per year but has a lower credit score and relatively high debts. Your paycheck isn’t the only thing that decides your buying power. Make sure you think about these other major factors to get a sense of how much you’ll be able to borrow to buy a house.

The Ascent, a Motley Fool service, does not cover all offers on the market. Maurie Backman is a personal finance writer covering topics ranging from Social Security to credit cards to mortgages. She also has an editing background and has hosted personal finance podcasts.

One big change from the first example is that private mortgage insurance (PMI) premiums are required since the buyer put less than 20% down. The $100,000 earner in our first example has an excellent credit score of 740. This person also has no monthly debts and is prepared to put down 20% on the home. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site.

A little work can transform a home into your dream house — without breaking the bank. In order to avoid the scenario of buying a house you truly can’t afford, you’ll need to figure out a housing budget that makes sense for you. You should also consider how important it is to you to have extra money for things like leisure and vacations. The more you spend on a home, the less you'll have left for the things you enjoy.

Don’t do anything that might negatively alter your score, like open up new credit accounts or buy a new car, while you’re actively trying to raise it. And when you’re ready, make sure you have an experienced local real estate agent by your side. An agent who knows your market can help you find the right home at the right price for you. Many buyers forget to account for closing costs in the total purchase price. The minimum income necessary to purchase a condo or townhome, according the report, is $91,200 for a $465,000 median-priced condo or townhome with monthly payments of $2,280. This means that banks get paid even if you default on your mortgage, and so are likely to be more flexible with their credit and down payment requirements.

No comments:

Post a Comment